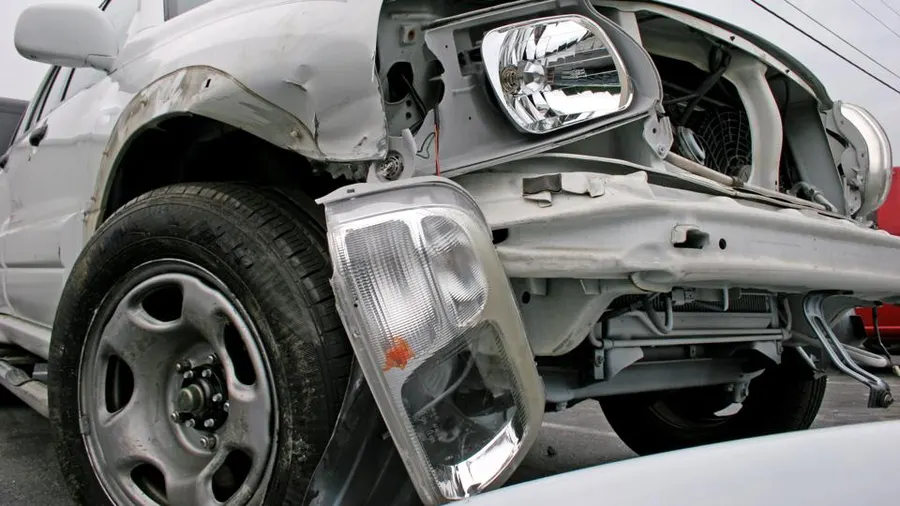

As the name implies, collision coverage pays to repair or replace your vehicle if you collide with another vehicle or object, such as a lamppost or curb. It may also pay if another driver hits your car but does not have adequate insurance to cover the damage.

Collision insurance is optional if your vehicle is paid off. However, if you finance or lease it, your financing firm would most certainly require it until the conclusion of the contract.

What does collision insurance cover?

Collision insurance pays for damage to your own car from:

- A crash you cause with another driver.

- A collision with another item, such as a tree or mailbox.

- Your car rolling over.

- Another driver hitting your car if they do not have enough or any insurance to cover the damage, and you do not have uninsured/underinsured motorist property damage coverage.

- Damage from potholes or hitting a curb.

- Hit-and-runs.

Collision insurance won’t pay for:

- Car damage from non-traffic events, like running into a deer, extreme weather or theft.

- You cause damage or injury to others while driving.

- Medical expenses resulting from injuries to you or your passengers in a car accident.

- Personal things in your car.

- Normal wear and tear.

If your car is damaged but not totaled: Collision insurance pays to repair your car to its previous condition, minus your deductible.

If your car is totaled: Collision insurance will pay the actual cash value of your vehicle, minus your deductible. Without collision insurance, if calamity strikes, you could end up paying thousands of dollars for car repairs or a new vehicle.

How collision insurance works when the other driver is at fault

If you are in an accident and another motorist is totally at fault, that driver liability car insurance will cover the damage to your car.

However, in many states, liability auto insurance minimum amounts are as low as $5,000 or $10,000. Given that the average cost of a new car is approximately $50,000, a driver who only has state-required liability coverage would not be able to pay for a totaled vehicle. If you are involved in an accident and the at-fault driver’s liability limitations are insufficient, your collision insurance will pay for the damage to your car.

Collision insurance vs. comprehensive insurance vs. full coverage insurance

While collision coverage pays for collisions, comprehensive insurance covers non-crash damage to your car, such as fire, hail, or theft. Full coverage car insurance includes collision and comprehensive insurance as well as liability insurance.

Do you need collision insurance?

Collision coverage, like your car, loses value over time because it never pays more than the car’s value. If you don’t have a loan or lease that requires it, collision insurance eventually loses its value, costing you more to maintain than it would reimburse you in the case of a crash.

How collision insurance works

Assume you were distracted in a parking lot and collided with a curb, causing damage to your car front suspension and other essential components. Here’s how collision insurance works:

- You document the damage and contact your insurer. You discover that if you make a claim, you will be reimbursed for the repairs.

- Your deductible is $1,000, and the damage will undoubtedly cost more to fix, so you figure it is probably worth making a claim.

- Because you also pay for roadside assistance (a relatively affordable add-on), your insurance will pay to tow your vehicle to its preferred repair shop. While you can choose your own mechanic for repairs, you decide it’s best to go with your insurance company’s recommended garage because your insurer will guarantee the repairs for as long as you keep the car and can pay the garage directly.

- Your insurance company sends an adjuster to assess your vehicle and estimate the initial repair expenses. The adjuster’s estimate is $4,100.

- You accept the estimate.

- Because you also pay for rental reimbursement coverage on your automobile insurance policy (which is often only available after getting comprehensive and collision insurance), your insurer will cover the cost of a rental car while yours is in the shop.

- You are told that your car has been fixed and is ready for pickup. However, before you can drive your car home, you must pay the auto repair company a $1,000 deductible.

Reducing or waiving your collision deductible

Remember that your collision deductible applies even if you are not at fault for the damage to your vehicle. If the at-fault driver does not have enough insurance to cover the damage, and you do not have underinsured or uninsured motorist property damage coverage (UMPD), collision insurance will pay for it.

If you believe it is unjust that you must pay to repair damage caused by someone else, you should consider lowering or eliminating your insurance deductible — which raises the cost of your insurance coverage — or adding a collision deductible waiver to your policy. This is only available in specific jurisdictions and waives your deductible if an uninsured motorist causes an accident for which your collision coverage must pay.

Another approach to reduce your collision deductible burden after an accident is to include “disappearing deductibles” (also known as “vanishing deductibles”) in your policy. Some auto insurance companies will reduce your deductible by a set amount, usually $100, for each year you go without an accident or a ticket. Details vary by organization, but disappearing deductibles typically cost more and may not be worth it if you are never in an accident.

How much does collision insurance cost?

Depending on the business, you may not be able to purchase collision insurance without comprehensive coverage, and vice versa. This could be because you have an active loan or lease that requires both, or your insurer requires one in order to acquire the other.

According to ReliableInsurance June 2024 review of national auto insurance rates, the average annual cost for full coverage insurance is $1,718. However, your own rates are likely to differ. That’s because car insurance companies base their prices on a variety of factors, including the car you drive, the number of miles you drive, and where you reside.